Peavey enterprises purchased a depreciable asset for 22000 – Peavey Enterprises’ recent acquisition of a depreciable asset for $22,000 marks a significant financial transaction that warrants in-depth examination. This purchase underscores the importance of understanding depreciable assets, their acquisition process, and the subsequent impact on financial statements and tax implications.

Depreciable assets are essential components of many businesses, and their proper management is crucial for accurate financial reporting and tax optimization. This comprehensive analysis will delve into the intricacies of depreciable assets, their acquisition, depreciation calculations, and the broader implications for Peavey Enterprises.

1. Depreciable Asset

A depreciable asset is a tangible asset that loses value over time due to wear and tear, obsolescence, or other factors. It is an asset that is used in the production of goods or services and has a limited useful life.

Examples of depreciable assets include buildings, equipment, machinery, vehicles, and furniture.

Depreciation is the process of allocating the cost of a depreciable asset over its useful life. This process reduces the asset’s book value and creates a depreciation expense that is reported on the income statement.

2. Acquisition of Depreciable Asset: Peavey Enterprises Purchased A Depreciable Asset For 22000

The process of acquiring a depreciable asset involves purchasing the asset and recording its cost in the company’s accounting records.

The purchase price of a depreciable asset is the amount paid to acquire the asset, including any sales taxes, delivery charges, and installation costs.

The acquisition of a depreciable asset has a significant impact on the company’s financial statements. The cost of the asset is recorded as an asset on the balance sheet, and the depreciation expense is reported on the income statement.

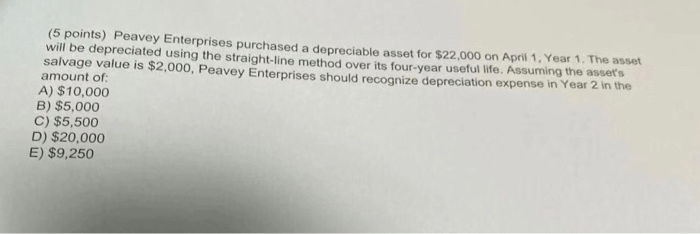

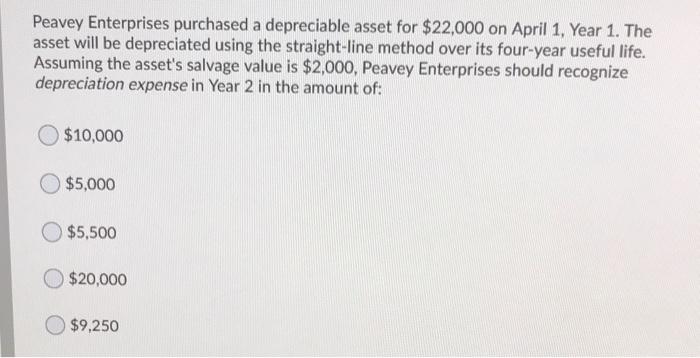

3. Depreciation Calculation

There are several methods used to calculate depreciation, including the straight-line method, the double-declining balance method, and the sum-of-the-years’ digits method.

The straight-line method is the most common depreciation method. Under this method, the depreciation expense is calculated by dividing the cost of the asset by its useful life.

The factors that affect depreciation rates include the asset’s cost, its useful life, and its salvage value.

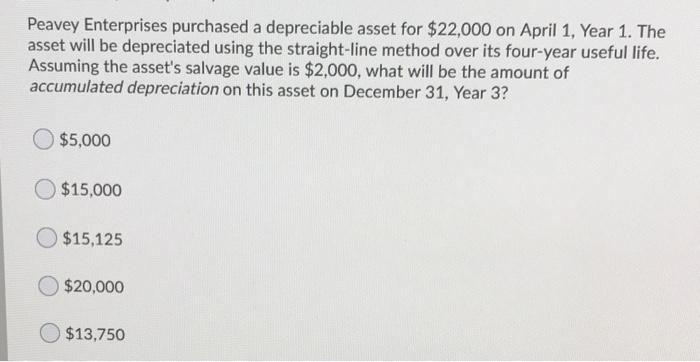

4. Depreciation Schedule

A depreciation schedule is a table that shows the depreciation expense, accumulated depreciation, and book value of a depreciable asset over its useful life.

The following table shows a depreciation schedule for the asset purchased by Peavey Enterprises:

| Year | Depreciation Expense | Accumulated Depreciation | Book Value |

|---|---|---|---|

| 1 | $2,200 | $2,200 | $19,800 |

| 2 | $2,200 | $4,400 | $17,600 |

| 3 | $2,200 | $6,600 | $15,400 |

| 4 | $2,200 | $8,800 | $13,200 |

| 5 | $2,200 | $11,000 | $11,000 |

The depreciation schedule shows that the asset’s book value decreases over time as depreciation expense is recorded.

5. Impact on Financial Statements

Depreciation has a significant impact on the income statement and balance sheet.

On the income statement, depreciation expense reduces the company’s net income. This is because depreciation expense is a non-cash expense that reduces the company’s taxable income.

On the balance sheet, depreciation expense reduces the book value of the asset. This is because depreciation expense is accumulated over time and reduces the asset’s cost basis.

6. Tax Implications

Depreciation has tax implications for companies.

Companies can deduct depreciation expense from their taxable income, which reduces their tax liability.

The tax treatment of depreciable assets varies depending on the country in which the company operates.

FAQ Insights

What is the purpose of depreciating assets?

Depreciation allocates the cost of an asset over its useful life, providing a more accurate representation of its value and reducing the risk of overstating profits.

How does the purchase price of an asset impact its acquisition?

The purchase price is the initial cost of acquiring the asset and forms the basis for depreciation calculations.

What are the different methods used to calculate depreciation?

Common depreciation methods include the straight-line method, declining balance method, and units-of-production method.